▶ What should I do if I have made an error when entering a transaction?

Realising an error has been made on a transaction is not uncommon, it happens - we all do it! That's why Scribe provides you with the flexibility to amend a transaction at a later date, providing a full change history audit trail.

Most errors on Scribe are best resolved by editing the transaction directly. This is the simplest method and should be used if the transaction error is not VAT related or if it is, has not yet been included in a VAT return or claim. Users should be mindful of the impact of amending dates or amounts on transactions that have been marked as Cashed. Any corrections/amendments made to transactions should always be checked before saving to ensure no other changes have inadvertently been made.

Read on for more information on correcting a transaction error:

The Transaction has NOT Been Included in a VAT Return (or VAT 126) Claim

If a transaction has not been included within a VAT return or VAT 126 submission, you will be able to make amendments to all fields including the VAT rate and amount. Simply select the three dots and 'Edit' to the right of the transaction, make necessary amendments and Save.

If the transaction is a duplicate or is not required please see: How do I deal with a Duplicate Transaction?

If you want to change the code of a transaction in the current period (to retain the integrity of previously produced reports) please see: VAT/Code Corrections for Payments or Receipts

Any changes made to a transaction will be logged. See Change History for more information on the audit trail provided.

The Transaction has been Included in a VAT Return (or VAT 126) Claim

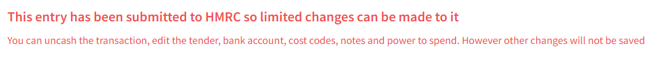

If a transaction has been included in a submitted VAT return then it will only allow limited edits:

Transactions included in VAT Form 126 Claim will not be locked (because the claim is not done via MTD) so remain editable. However, changes should not be made to the information submitted as part of the claim (e.g. voucher date, invoice date, supplier, VAT type or amounts).

To limit the scope for errors needing correcting after the submission of a VAT return or claim we strongly recommended the following steps are completed before submitting a VAT return or claim:

- Reconcile all accounts to the end of the period and ensure Reconcile All Banks balances.

- Review the VAT rate applied to transactions using the VAT List report.

If a transaction has been included within a VAT return or VAT 126 claim, the following options exist for correction:

- VAT/Code Corrections for Payments or Receipts: creates a reversing transaction and a replacement transaction that can be amended. Both transactions will be dated the date the correction is done.

- Manual correcting entries (should be used if the date of the VAT/Code Correction is not appropriate, e.g. the user requires the correction to appear in the next VAT return but today's date is beyond that date):

- Create a reversing entry. This will involve entering a duplicate of the original entry but with a minus sign in front of the values. The date of the reversing entry must fall within the next VAT period, but all other details should match.

- Create a correcting entry. Simply enter a new transaction with the correct VAT rate/amount that should have been applied. Again the date of the correcting entry must fall within the next VAT period.

- These two entries can be reconciled to the same date, and will net off against one another so as not to affect your bank reconciliation. The entries will also be included within the next VAT submission to correct the overclaim/underclaim.