How do I correct a VAT receipt/payment included in a VAT return?

VAT refunds from HMRC, and VAT payments to HMRC, must be recorded using 'R:Refund' as the VAT type in order for Scribe to correctly calculate your VAT position. If VAT receipts/payments have been recorded incorrectly, please see below how to correct.

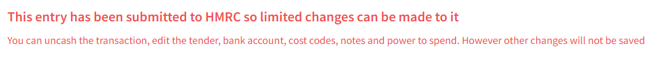

If a transaction has been included in a submitted VAT return then it will only allow limited edits:

If a VAT receipt/payment has been entered incorrectly and included in a VAT return, the following options exist for correction.

VAT/Code Correction

- This option creates a reversing transaction and a replacement transaction that can be amended to VAT type R:Refund.

- See VAT/Code Corrections for Payments or Receipts for steps on how to complete this.

*NOTE - Both transactions will be dated the date the correction is done (e.g. today's date). Therefore this option should only be used if today's date falls within next VAT submission. If this is not the case, manual correcting entries should be made.

Manual Correcting Entries

This option should be used where a VAT/Code Correction is not appropriate. Follow the steps below to complete.

- Create a reversing entry. This will involve entering a duplicate of the original VAT receipt/payment, but with a minus sign in front of the values. The date of the reversing entry must fall within the next VAT submission period, but all other details should match.

- Create a correcting entry. Enter a new transaction with R:Refund as the VAT type and enter the VAT amount in the VAT field. Again the date of the correcting entry must fall within the next VAT period.

- These two entries can be reconciled to the same date, and will net off against one another so as not to affect your bank reconciliation. The entries will be included within the next VAT submission to correct the over/underclaim.